Dealer News Today Interview with Apex Group Founder, Greg Gilmore

Buying a dealership is a significant investment that comes with a lot of paperwork. It is imperative that the buyer understand the process and be well prepared and professional when applying for a manufacturer license. This will give investors the confidence to back your business and convince the seller you are serious. Without a manufacturer license, there is no business. What happens with this process and how long does it take? What are the hurdles purchasers can expect? Greg Gilmore of The Apex Group answers some of the common questions and challenges that come with applying for manufacturer approval.

DAVE CANTIN: What is the importance of a buyer completing the manufacturer application and documents quickly and correctly?

DAVE CANTIN: What is the importance of a buyer completing the manufacturer application and documents quickly and correctly?

GREG GILMORE: Typically, the buyer only has one opportunity to submit their application package to the manufacturer. I can’t stress how important it is to not procrastinate on the submission of the application and to start preparing the documentation immediately. Manufacturers will follow state statutes regarding the time it takes to review the package and the timing of approvals. Typically, the manufacturer has 60 days to decide once they’ve receive all the required documents. All of the required documents are the key. For example, if your floor plan approval isn’t in or you haven’t turned in the paperwork for your checking account, then you haven’t completed all the required documents and the clock hasn’t started. Many times, this delay will take it past closing deadlines, which are detailed in the sales purchase agreement. If the manufacturer feels as though they do not have enough time to review the package in relation to state statutes, they will typically send a soft turn down letter

Accuracy and completing the application correctly the first time are very important. As an example, all manufacturers require a pro forma in their own unique format. Many of the manufacturers utilize the pro forma to set the working capital requirement. Others will base it on their internal planning volumes. Therefore, it is so important to submit the pro forma correctly the first time. Since they are using this document to calculate initial operating investment and source of funds documentation, they expect the document to be accurate. If it’s not completed correctly, or too aggressively/not aggressively enough, it could cost the buyer hundreds of thousands of dollars in excess of the initial operating investment. Once the working capital guide has been determined by the manufacturer, it is very difficult to revise the pro forma. Make sure it’s done correctly upon initial submission. Each manufacturer has their own specific nuances when it comes to pro forma preparation.

Overall accuracy in every application document is very important. If there are any inaccuracies in the submission, it could come back around to the dealer—even years later. If the manufacturer and dealer have any problems that might result in later legal litigation, the accuracy of the initial application could become a key factor and exhibit in the process.

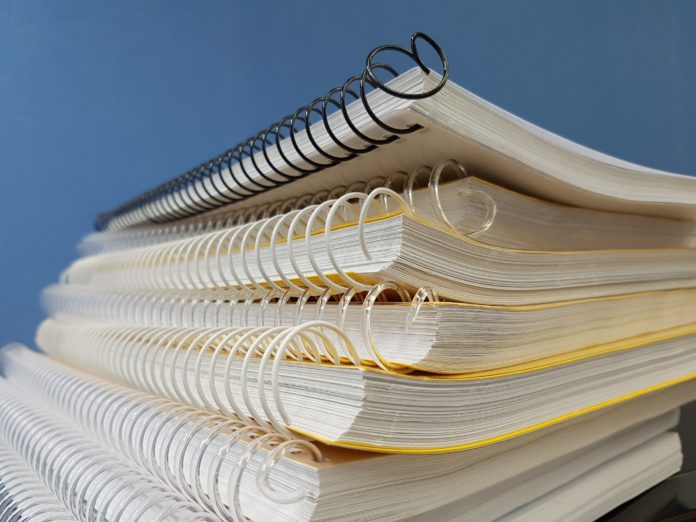

DC: What is the average number of required documents?

GG: This varies among manufacturers. If you include manufacturer sign-up forms, this could be well over 100 documents.

Some manufacturers have an online system where you can upload every single document onto their network, others are completely offline, and some use a combination of both.

What is consistent among the manufacturers is the grouping of documents. I typically break down every deal into six specific groups.

Management document – Personal application information, background checks, and biographies are all part of this group. Also, one of the most important aspects in the past five years has been verification of customer satisfaction performance, sales efficiency performance, and profitability. Especially sales efficiency. Manufacturers have been setting specific guidelines on sales effectiveness to pass to the next application level. This didn’t use to the case, but minimum sales effectiveness criteria are now used by virtually every manufacturer. Falling below a specific manufacturer sales efficiency benchmark can result in an immediate turn down.

Legal documents – These include your sales purchase agreement, attorney’s letter, company formation documents, and tax ID numbers. It’s important to have your attorney work on these documents on Day One. Some manufacturers require an attorney summary letter before they will issue the full document checklist.

Projections – Opening day balance sheet, pro forma and business plan documents. Most manufacturers have a specific template for each of these documents. Our firm maintains these documents on file so we can give our clients a head start. We often work on the projections within the required manufacturer format before the official application checklist is sent to our clients.

Financial documents – These include copies of any capital notes with approvals, floorplan, verification of equity contribution, and source of funds documents.

Facility documents – Real estate purchase agreements, appraisals and lease agreements.

Program documents – All the various manufacturers’ sign up programs. During the application process, manufacturers are in the best position they’ll ever be in to encourage their dealer body to sign up for their specific programs. They take advantage of this and put every form possible in front of their applicants.

DC: What is the importance of the buyer and seller following up with the manufacturer on the status of the application?

GG: It’s important for both the buyer and seller to follow up with the manufacturer on the status of the package, however, it’s more important for the buyer to stay on top of their submission documents. The manufacturer is guided by state statutes on how quickly they need to turn the package around. For the most part, manufacturer market representation managers stay on top of the application process. Of the 50 to 100+ deals we work on each year, if there’s a delay it’s typically because the buyer hasn’t provided us with some basic information needed to complete the package in a timely fashion. The manufacturers are under a state statute on how quickly they can turn this around—typically no longer than 60 days . The buyer has a lot of moving parts to deal with and it can become overwhelming. Even if the buyer has completed dozens of deals in the past, each manufacturer has their own intricacies and there are many other priorities at the dealership to be taken care of besides processing application paperwork. If completing the application package is all the dealer did during the day, then there wouldn’t be any problems, but we all know dealers face many operational, advertising and staffing challenges on a daily basis.

We typically spend just as much time with our seasoned and experienced dealership buyers of as we do with our first-time buyers. We always provide our clients with a daily update on where everyone is at on the package and what is still needed for a complete and final package. That list starts off as very detailed and works down to one or two points per day by the end of the process. Included in our updates are the attorneys, accountants, the bankers and, of course, the management team.

Beyond ownership change and buy/sell packages, our firm completes open point presentations, individual pro formas/business plans, market studies, relocation analysis and primary market area or area of responsibility definitions. The primary market area definitions are extremely important for clients that may not be achieving sales efficiency. If the market isn’t drawn out correctly by the manufacturer, then it could be virtually impossible for the dealer to achieve sales efficiency.

Preparing a dealership application can be very tedious. It’s about as fun as going to the dentist or preparing your taxes. It must be done and it’s often put off. But the main difference here is that you can’t reschedule and you can’t count on an extension. Our clients may have hundreds of millions of dollars in the bank, however without manufacturer approval, they will not obtain the franchise agreement, or the dealership.

The Apex Group was founded by Greg Gilmore, a former market representation executive with Toyota Motor Sales, USA and is entering its 20th year of franchised automotive dealership consulting. The company mission has always been to be the automotive industry leader in providing market representation support to franchised dealers. The company has worked with virtually every automotive manufacturer doing business in United States.

The Apex Group has developed over 1,000 market representation packages for dealer clients across the United States in the past 20 years. Utilizing this experience, the firm has become the industry’s premiere resource in providing consultation on the intricacies of each of the automotive manufacturer’s dealership management, capital and facility policies. Beyond ownership change and buy sell application packages, Apex has developed detailed market studies, relocation analysis, primary market area definitions, open point presentations, business plans and pro forma projections for its clients.