By Amy Corr

When consumers research their next car, there’s undoubtedly a few must-have requirements, whether it’s model, engine size, leather seats, and heated seats. Just how many car buyers go to the extreme with necessities and non-negotiables? Data shows it’s a small percentage. So why do dealerships stock so many low selling cars when most consumers want, and buy, basic model configurations?

Brian Finkelmeyer, Senior Director of vAuto, discussed this issue with Dave Cantin and Andy Cherkasky during a recent podcast.

Finkelmeyer began with decent news, noting that new car sales were only down 7% compared to a year ago, pre-pandemic.

Total inventory, however, was down 1 million cars before the pandemic. Finkelmeyer said it will be a rocky road to replenish shelves and the breakdown of the global supply chain will add additional strain.

“North America production is forecast to be down 3.5 million units in 2020, which is a pretty significant number,” said Finkelmeyer. “The best that we can hope for to get these 3.5 million cars back is sometime in 2021. The lesson to OEMs and dealerships is how can we manage inventory more efficiently?”

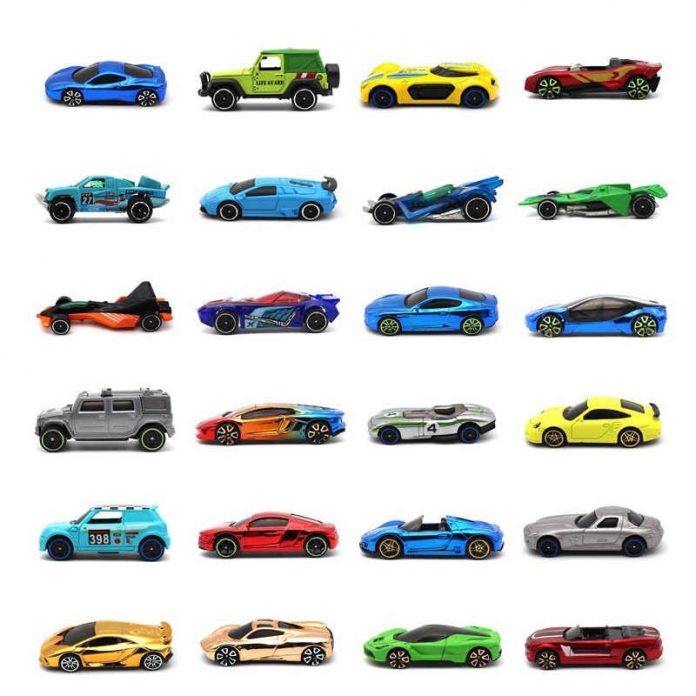

Here’s where unicorns come in. The mythical creatures take on an additional role in the automotive industry: profit destroyer.

Unicorn cars make up a small percentage of sales, and sit on a dealership’s lot for longer than average.

A study by J.D. Power discovered that 98% of all configurations sell less than 50 units each, equal to 26% of total sales. An alternate view is 2% of configurations account for 74% of sales.

“A small fraction of different combinations really drives the volume,” continued Finkelmeyer. There’s lots of unicorns out there that tend to slow down sales velocity.”

Doug Betts, President, Automotive Division, at J.D. Power, noted that 2019 had 605,000 different configurations, excluding color. That averages to 22 cars sold per unique configuration for all of 2019.

This year, 2020, has been stunted due to the pandemic and already has more than 423,000 different configurations.

A parts supply issue is taking place in the factories that are starting up again. They are having to stop work because they are waiting for parts.

“If you are going through the trouble of making a unique version of a vehicle and it only sells 10 units, you have to question did you really need to make that and did you have to spend that money,” pondered Betts.

“Are people buying a configuration because it’s what they created and dreamed of or because it’s there in the showroom,” continued Betts. “We build a lot of unicorns in this market and it’s unclear if we should.”

J.D. Power found these unicorn vehicles are slower to sell and 61% perform below average of their respective model.

Finkelmeyer believes this is the time for car companies to take a closer look in the mirror. He discerns that dealerships should be rewarded on a turn and earn basis and hone in on new car inventory management.

After querying a series of dealerships regarding how many hours a month they devote to new car inventory management, Finkelmeyer found the average was 2 hours a month, with one dealer saying it’s actually much less than that.

“I know dealers who looked at how they can make their new car inventory a competitive advantage in the marketplace and it pays a lot of dividends,” said Finkelmeyer.

Research needs to happen regionally so dealerships and automotive manufacturers can view performance numbers with a broad brush and a local brush. Numbers that might look promising and successful nationally may likely be the opposite regionally.

“Eliminating vehicle configurations that are slow to turn can improve numbers,” said Betts. “Low margins can move performance up. The difference in performance regionally and nationally is significant. It could look like things are going good but some regions are not faring well. Research must be done at a regional level.”

The report also noted that vehicles in the U.S. are sold from stock while in Europe they are built to order. This makes it nearly impossible to determine stateside if a vehicle was purchased because it checked off all the necessary boxes for a buyer, or if it was purchased because it was on the lot and available. It also notes that the industry hasn’t seen rock bottom yet in terms of the car shortages affecting many regions; J.D. Power says it will get worse before it improves and the path to a pre-COVID-19 outlook will be non-linear.

To poorly paraphrase the musical group, TLC: Don’t go stocking unicorns. Please stick to the sellable configurations that you’re used to.